The past 5 months have been nothing short of exciting for vacation rental companies.

A series of mergers and acquisitions are reshaping the industry; startups are getting incredible opportunities to prove their worth; investors are betting on companies that emerged from pandemic-related trends.

As a leading channel manager for vacation rentals, we like to keep our finger on the pulse of the industry. At the end of April, we shared our roundup of major vacation rental M&A and investment deals up until that point. And now, we’ve compiled a follow-up listing the most significant deals announced since the beginning of May.

Main takeaways:

- The industry has a series of IPOs via SPAC mergers to look forward to. The likes of Sonder, Vacasa and Inspirato are all planning to go this route, and HomeToGo has just completed its merger.

- Not all property management companies that received investment are based in Europe and North America. Startups from other continents are also turning investor heads, with H2O Hospitality (Japan), OYO (India) and Mabaat (Saudi Arabia) each raising significant funds.

- Startups in the camping/glamping and outdoor travel space have been especially popular among investors. This is undoubtedly due to the surge in demand for domestic and nature travel following pandemic lockdowns. Companies that raised funds in the past 5 months include camping startups HolidayFox and Wildpoint, RV rental marketplaces Outdoorsy and RVezy and cabin rental platform Raus.

- M&A activity and consolidation has sped up in the leisure accommodation sector. Awaze, already the largest vacation rental property manager in the world, has made new strides towards dominating the European market through a series of acquisitons. In the US, VTrips continued its acquisition spree to roll up rival players in leisure destinations.

And now, let’s take a closer look at the vacation rentals mergers and acquisitions and investment deals that went down in the past 5 months.

Property management companies | Software companies | OTAs and niche channels

Property management companies

Mergers and acquisitions

- Habicus Group, the parent company of SilverDoor Apartments acquired The Apartment Service, uniting two large serviced apartment agents and increasing the group’s market share.

- Serviced Apartments Platform AG, based in Switzerland, acquired the German serviced apartments provider Acomodeo, which it has previously invested in.

- Paris-based Le Collectionist acquired Bramble, a company managing 160 ski chalets in France, Switzerland and Austria. This came as part of Le Collectionist’s goal to become a market leader in the European luxury villa and chalet space.

- Red Savannah, a UK-based private villa rental company acquired US-based Homebase Abroad, a company managing vacation rentals in the Italian market.

- Florida-based VTrips, a fast-growing property management company with over 3,000 rentals and history of acquiring smaller players, has made yet another series of acquisitions. Resort Property Management (Tennessee) and Distinctive Beach Rentals and Resort Collection (Florida) are now owned by VTrips, furthering consolidation in the North American resort vacation rental space and boosting VTrips’s chance to become a leader. What’s more, VTrips plans to spend another $250 million on acquisitions in the near future. Learn Funding Options.

- Cosi Group, based in Germany, acquired Awaze’s Friendly Rentals brand to accelerate its expansion into Spain. Friendly Rentals manages urban units in cities Barcelona, Valencia and Seville. It was previously owned by Awaze’s Novasol brand and sold as part of Awaze’s strategy to focus exclusively on rural properties.

- Awaze made a string of acquisitions, adding thousands of properties to its already large portfolio of over 100,000 units. In May, the company acquired Amberley House and Portscatho Holidays in the UK and Bornholmtours in Denmark. This was followed by the acquisition of UK-based Quality Cottages and sister brand Quality Unearthed in September, further expanding Awaze’s inventory in Europe. In addition, as part of its plan to focus on rural holiday homes, Awaze has sold some of its park units and urban properties.

IPOs

- OYO, a fast-growing hospitality brand that owns OYO Vacation Rentals, is set to file for its $1.2 billion IPO in the last week of September. The Indian startup’s investors include SoftBank, Airbnb and Lightspeed Partners.

- The Travel Chapter, a UK-based holiday let agency that owns Holiday Cottages and other brands, is rumoured to be preparing for an IPO. With more than 7,000 rentals under management, The Travel Chapter is a large player in the UK that was valued between £100 million and £200 million in 2018.

- Vacasa, North America’s largest full-service vacation rental management company, is set to go public via a SPAC merger with TPG Pace Group. The company is forecasted to have a $4.5 billion valuation as a result of the IPO.

Investment deals

- June Homes, a New York-based vacation rental company on a mission to create a fair, transparent and efficient real estate system announced that it has raised $50 million in funding. This includes a $27 million Series B and a $13 million Series A round, as well as $10 million in seed funding.

- Blueground, an urban property management company raised $180 million in Series C funding. The round was led by Laurence Tosi, managing partner at WestCap Group. Blueground plans to use the funding to expand its offering of 5,000 apartments around the world.

- H2O Hospitality, a property management company based in Japan, raised $30 million in a Series C funding round led by Kakao Ventures. The company operates around 7,500 units in Tokyo, Bangkok, Seoul and Busan.

- Mabaat, a property management and proptech startups based in Saudi Arabia raised $2.4 million in a seed funding round led by Derayah Ventures.

- VTrips received a private equity investment from Hudson Hill Capital to fuel its expansion and M&A efforts.

- Frontdesk, a tech-enabled vacation rental startup based in Milwaukee, raised $7 million in venture capital in a round led by Stormbreaker Ventures. This brings the company’s total funding to $18 million. The funds will be used to grow both the management and technology sides of Frontdesk.

- Raus, a Berlin-based cabin rental startup, raised a seven-figure pre-seed funding round led by early-stage investor Speedinvest. Raus operates on a revenue share model and plans to partner with farmers and forest owners to build sustainable cabins on their lands.

- India-based OYO, a large hospitality chain with over 50,000 vacation rentals around the world, secured a $660 million loan from global institutional investors. A couple of months later, the company also landed a $5 million investment from Microsoft.

- Cabana, a US-based rental startup that offers a fleet of vans designed as “mobile hotel rooms”, raised $10 million in a Series A round led by Craft Ventures.

- Away Resorts, a holiday park operator in the UK received a £250 million investment from private equity firm CVC Capital Partners.

Software companies

Mergers and acquisitions

- Mews, a cloud-based property management system for hotels and vacation rentals, acquired UK-based rival Hotel Perfect. This came as a continuation of Mews’s strategy to roll up fellow PMSs: the company had previously acquired Planet Winner and Base7Booking.

- Operto, a property automation system that integrates a wide range of smart devices, acquired VRScheduler, a workflow automation platform. The deal is the result of Operto’s efforts to diversify its offering of operations management tools. VRScheduler will continue to live on as a separate brand.

IPOs

- SmartRent, a leading smart home automation provider, went public in a $2.2 billion SPAC merger.

Investment deals

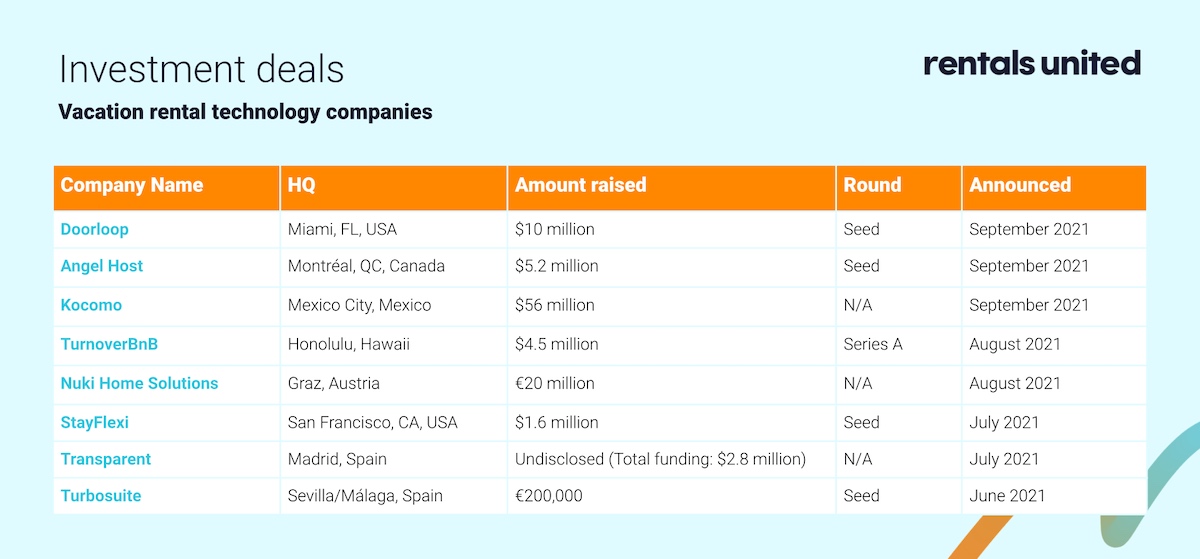

- Doorloop, a property management software company, raised $10 million in seed funding led by its founders and private investors.

- Angel Host, a startup that specialises in helping property managers maximise revenue closed a seed funding round of $5.2 million for developing its vacation rental technology.

- Kocomo, a startup based in Mexico City that allows people to co-own luxury vacation properties, raised $56 million. The round was led by AllVP and Vine Ventures. Kocomo’s goal is to democratise vacation rental home ownership.

- TurnoverBnB, a company that helps property managers schedule and manage cleanings automatically, raised $4.5 million in series A funding.

- Nuki Home Solutions, a company specialising in smart access control for vacation rentals, closed a new financing round worth more than €20 million.

- StayFlexi, an operating software and upselling platform for hotels and vacation rentals, received $1.6 million in seed funding.

- Transparent, a leading vacation rental data and market intelligence provider received funding from JetBlue Airways, bringing the company’s total funding to $2.8 million.

- Turbosuite, a PMS and booking accelerator tool for vacation rentals, raised €200,000 in its first seed round. The company is based in Málaga and Seville, Spain.

OTAs and niche channels

IPOs

- HomeToGo, a leading vacation rental metasearch engine based in Berlin, Germany, went public at €1.2 billion through a merger with Lakestar SPAC I. The merger was first announced in July and the transaction was completed in September. HomeToGo received a €250 million funding injection as a part of the process. The company, which will continue operating as HomeToGo, plans to invest in growth and broadening the platform’s existing services.

- Inspirato, a luxury vacation rental subscription service, is set to merge with Thayer Ventures and go public via SPAC. Once the deal goes through, the company will be valued at an estimated $1.1 billion.

- Camplify, a peer-to-peer caravan hire and RV sharing marketplace based in New South Wales, Australia, went public via a AU$11.5 million IPO. The startup founded in 2015 has been one of the winners of the increase in domestic and outdoor travel that resulted from the pandemic.

Investment deals

- HolidayFox, a London-based startup that has built a search platform for campsites, raised £1.17 million in pre-seed funding led by Fuel Ventures.

- Wheel the World, a niche channel listing accessible accommodation and experiences for travellers with disabilities, raised $2 million in a seed funding round led by Chile Global Ventures and Dadneo.

- Exoticca, a online travel agency that provides holiday packages for people looking for a unique holiday experience raised $30 million in series C. The round was led by 14W and Mangrove Capital Partners with Aldea Ventures and existing investors involved too.

- Stayfolio, a listing site for luxury vacation rentals and boutique hotels based in South Korea, raised a $4.5 million investment round from TBT Partners and Quad.

- Wildpoint, a camping marketplace where travellers can book outdoor accommodation from tent to glamping yurts and cabins, raised £265,000 in pre-seed funding.

- Outdoorsy, an RV rental and outdoor travel marketplace, received $120 million in equity and debt financing. The funding will be used to grow Outdoorsy and develop its insurtech product Roamly. Previously, Outdoorsy had itself invested in luxury accommodation provider Collective Retreats.

- Handiscover, a startup focused on accessible short-term accommodation for people with disabilities, raised €1.65 million. The majority of the funding received (€1.5 million) came from the European Innovation Council, with the rest coming from Handiscover’s existing investors HOWZAT Partners, Almi Invest and Tranquility Capital.

- RVezy, a Canadian peer-to-peer RV rental marketplace, raised $23 million in investment to attract more RV owners and expand across the US.

- Vacayou, a wellness travel platform that helps people book wellness retreats and travel experiences, raised $3.3 million in combined angel and seed rounds.

- Holidu, a leading vacation rental metasearch OTA, raised $45 million in a series D round led by 83North as well as existing investors.

- Gathern, a women-led Saudi Arabian vacation rental marketplace raised $6 million in Series A funding. The round was led by Saudi venture capital firm STV with participation from existing investors.