As we transition into 2026, the short term rental landscape has officially moved past the era of recovery. The 2025 cycle was defined by a new baseline of stabilizing occupancy and a surge in last minute guest demand. For property managers, the reality of pricing resilience is no longer a future concept but a current requirement.

The shift from reactive management to strategic optimization is now complete. Success in this new market requires more than just intuition. It demands integrated tech ecosystems and a revenue-first mindset fueled by real-time data and agile distribution.

In this article, we analyze the defining highlights of 2025 and provide the strategic roadmap for property managers ready to grow beyond their current limits.

How are supply, demand, and pricing shaping short-term rentals?

The industry is entering a phase of professionalization where demand is being spread over a cooling supply of available nights.

Supply and demand dynamics

- Occupancy trends: In Q1 2025, US occupancy dropped by approximately 3% year-over-year. However, guest nights actually increased slightly by 2%, signaling that demand remains strong but is distributed across more inventory.

- Forward outlook: Pacing data for Q2 2025 shows higher performance than the previous year, suggesting that occupancies will trend back toward long-run norms over the next 18 to 24 months.

Which regions led vacation rental growth in 2025?

Performance in 2025 is highly regionalized, with inland markets showing significant resilience. As North American supply growth cools (+3%) and APAC explodes (+22%), success in mature markets requires a shift from simple presence to operational mastery.

Americas: North America cools and LATAM grows

The Americas remain a tale of two markets: high-revenue established hubs and high-growth investor hotspots.

- North America: Continued its dominance, capturing roughly 38% of global revenue in 2025.

- LATAM momentum: Rio de Janeiro saw a 17% inventory spike, while cities like Mérida became high-yield magnets for digital nomads.

EMEA: Supply powerhouse

Europe remains the world’s most supply-heavy region, even as Africa sets a record pace for new capacity.

- Europe: Now hosts over 4.34 million properties.

- Urban revival: Major cities are booming despite regulations, with Rome up 23% and Athens up 22%.

- Mainland performance: Hubs like Girona, Spain, achieved impressive 73% occupancy rates.

APAC: The leading market in short-term and vacation rentals

APAC is officially the fastest-growing market on the planet, fueled by a massive rebound in international travel.

- Rapid acceleration: The region is on track for a 14.2% CAGR through 2030.

- Supply explosion: Guest capacity surged 22% YoY, adding 350,000+ new spaces in just one year.

- Revenue peak: Japan’s inbound recovery has created goldmines like Okinawa, where properties are topping $60,000 in annual earnings.

How has guest behavior changed in the short-term rental and vacation rental market?

Guest behavior: Experience over bed count

The 2025 guest is more researched, booking later, and seeking immersive experiences over simple utility. So, to answer the question: How are travelers booking differently in 2026?

Shifting booking windows

- Early research, late commitment: Booking windows shrank by 3 days in Q1 2025. However, summer 2025 windows are the longest seen since 2022.

- Last-minute agility: Travelers are browsing early but locking in dates late, making early visibility and last-minute pricing agility critical. Last minute deals on platforms like Airbnb help gain control of this trend.

The immersive experience

Today’s guests prioritize restorative and unique moments, often choosing their destination based specifically on the immersive experiences available nearby.

tThe first platform to launch experiences was Airbnb, redefining itself as more than an accommodation provider, evolving into a comprehensive travel ecosystem. A major pillar of this transformation was the complete relaunch of Airbnb Experiences, designed to meet the surge in “experience-first” travel dominating guest behavior.

- Amenity ROI: Click-through rates are significantly higher for listings highlighting immersive add-ons like chef nights, EV chargers, and dedicated workspaces.

How property managers use AI to increase revenue?

2026 is already promising how AI will revolutionize the short-term rental industry. So far, in 2025 strategic application of AI has transformed the industry over the past year. This year we saw technology move from a simple convenience to a core requirement for operational excellence and revenue protection.

As a revenue-first channel manager, we’ve witnessed first-hand how property managers are no longer just “testing” AI; they are harvesting real-world results that scale their portfolios without adding complexity.

Below, we’ve rounded up the AI-driven strategies that made the biggest impact in 2025.

Strategic shifts with AI and data

- Predictive analytics for vacation rentals: High-performing portfolios now use predictive models to develop long-term market forecasts rather than just reacting to current trends. This allows managers to identify high-yield investment opportunities and anticipate shifts in guest demand before they happen.

- AI-Powered content optimization: Visibility in the AI era depends on structured, machine-readable property content. AI tools now audit listings to identify content gaps, ensuring your properties are visible to the next generation of conversational trip planners used by major OTAs.

- Automated guest mastery: AI has revolutionized communication by automating up to 90% of routine guest interactions. By using AI-driven systems that integrate directly with your PMS, managers can deliver instant, 24/7 multilingual support that builds the “Automated Trust” necessary for high search rankings.

Harvesting operational excellence

The “final frontier” of AI isn’t just about speed; it’s about efficiency and cost reduction.

- Efficiency boosts: Integrating AI into guest communication and service coordination has resulted in a 30% boost in overall operational efficiency for professional property managers.

- Proactive reputation management: Using AI to automate and personalize host reviews saves hours of manual labor every week while increasing response rates and property visibility.

- Smart distribution: AI-driven dashboards now signal exactly where pricing elasticity lies across multiple channels, allowing managers to apply surgical incentives that fill gap nights and protect RevPAR.

By embracing these reliable resources, property managers can support smarter decisions and more efficient operations as we head into the new year.

What were the best performing channels for vacation rental distribution in 2025?

So it happens that channel management is not dead, it just evolved into a new way of advertising and distributing any type of portfolio. With emerging channels, new connectivity features within main OTA’s and specialist listing sites, the distribution landscape is more alive than ever.

Simply listing is not enough, and we know what we’re saying. The market is growing a competitive landscape, and this is the reason why the big players like Airbnb, Booking and Expedia are developing the revenue features that make a simple listing go from bottom of search results to most loved and booked properties.

If you know your market, the travel segment behavior you know how to drive occupancy rates up. As a revenue-first channel manager, we have the features to help you capture demand. Rentals United as the leading vacation rental channel manager gathered worldwide data to analyze the best performing channels by region.

Distribution strategy for short-term rentals and vacation rentals: diversify to conquer

The “Billboard Effect” remains powerful, but the specific channel mix is shifting toward a blend of major OTAs and specialist platforms.

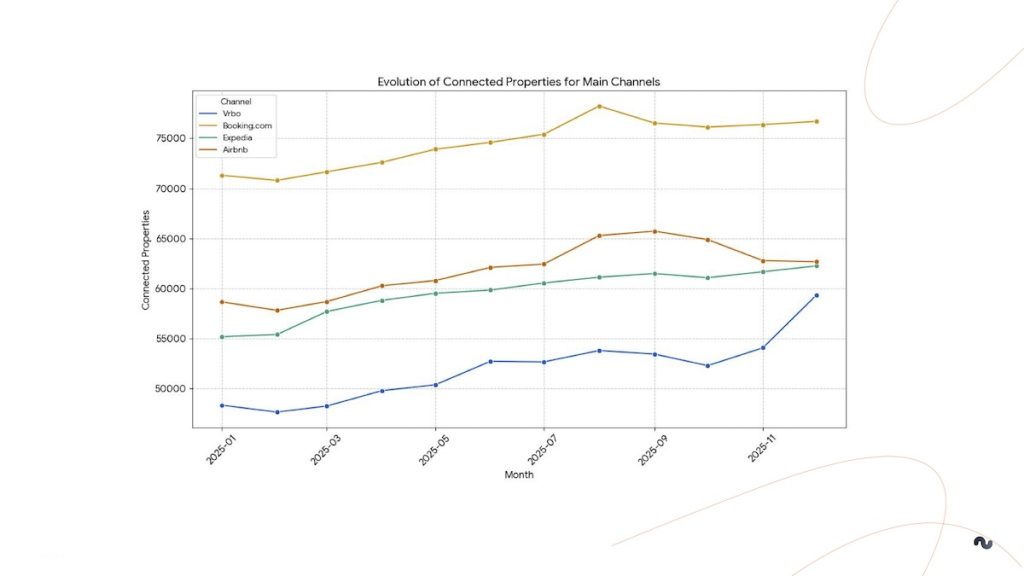

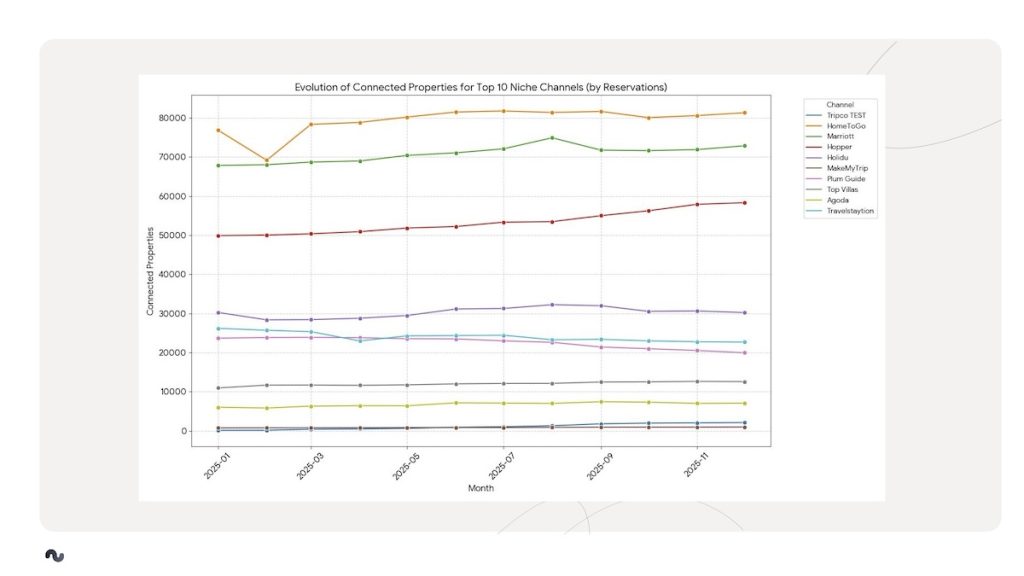

In 2025, internal data shows Booking.com and Airbnb continued to lead the market, driving the highest property connections and booking efficiency during the August peak season. HomeToGo and Marriott expanded their footprint among niche and branded channels, while Agoda and MakeMyTrip recorded the fastest growth, achieving standout reservation-to-property ratios. Overall, the year reflected a strong, diversified rebound in global travel demand across all major distribution platforms.

The Evolving landscape of listing sites

- OTA strategy shifts: Airbnb exclusive listings dropped by 11.05%, while Booking.com exclusive listings rose by 10.6%.

- Expedia growth: Expedia reported a 12% increase in booked room nights in late 2024, with vacation rentals playing a central role.

- Urban revival: Urban inventory is climbing again, often at premium price points, with visibility on hotel-oriented OTAs doubling in some markets.

The best performing connectivity features

- 3 times more revenue: Properties utilizing flexible pricing through Multi-Rates on Booking.com and Expedia earned 3 times more revenue than single-rate listings.

- Mobile dominance: With 50% of bookings made on mobile, utilizing mobile-exclusive rates is essential for capturing a majority of the market.

The large manager benchmark

When it comes to enterprise companies the success relies on a fully integrated tech ecosystem. One where all stakeholders (owners, investors, managers and guests) are fully connected and informed.

For companies managing 100+ units, the strategy has shifted toward total ecosystem control. This is what internal research from Rentals United clients and partners has shown.

- PMS Integration: 98% of large managers rely on a PMS to handle high-volume operations.

- Tech stack customization: Leading managers use custom API integrations to ensure real-time synchronization of rates, content, and availability across 90+ channels.

- Revenue protection: Professional portfolios utilize daily rate updates and progressive markups deep in the calendar to protect RevPAR as supply growth slows.

To scale effectively, smaller property managers must adopt the data-driven habits of large enterprises: automate guest communication, extend availability windows, and act on weekly performance metrics.

Frequently Asked Questions

How many people use vacation rentals? The number of global users continues to climb as market penetration deepens, with more travelers choosing rentals for immersive experiences over traditional hotels.

How much is the vacation rental industry worth? The global market cap has surpassed previous projections, with demand in North America exceeding pre-pandemic levels as of late 2024.

How many vacation rentals are in the US? Supply growth is cooling after a period of rapid expansion, forcing managers to compete on quality and unique amenities rather than raw volume.

Ready to turn this data into revenue? Rentals United provides the technology and expert coaching you need to grow your business without disruption