The past two years have proven to be transformative for vacation rentals. In response to the pandemic and the unpredictable fluctuations in market demand, many property managers made significant changes to how they run their businesses. New booking behaviours and travel trends were born, directly impacting the performance of short-term rental operators around the globe.

In an effort to tally the changes and assess the current landscape of vacation rental property management, we teamed up with Transparent to bring you the Global Vacation Rental Report 2022 . This is one of the most detailed and comprehensive examinations of our industry to date, with data from 164 property managers in Europe, North America, Latin America, Asia and Oceania.

To understand the behaviour and sentiment of property managers around the globe, we examined a variety of topics ranging from operations to distribution, technology adoption, pricing strategies and data usage. We then analysed responses by operation size, location and market type to gain more specific insight.

Download the report now or read on for some highlights.

About the survey

The Global Vacation Rental Report 2022 is based on a survey completed by 164 global property managers.

The respondents represent more than 62,000 properties in total and hail from Europe, North America, Latin-America, Asia, Oceania.

The property managers surveyed are of different sizes, managing from 2 to over 100 rentals in urban, coastal, rural and ski destinations.

Top findings

Compare global data with 2022 Industry Predictions.

Property managers are confident in the industry’s imminent recovery

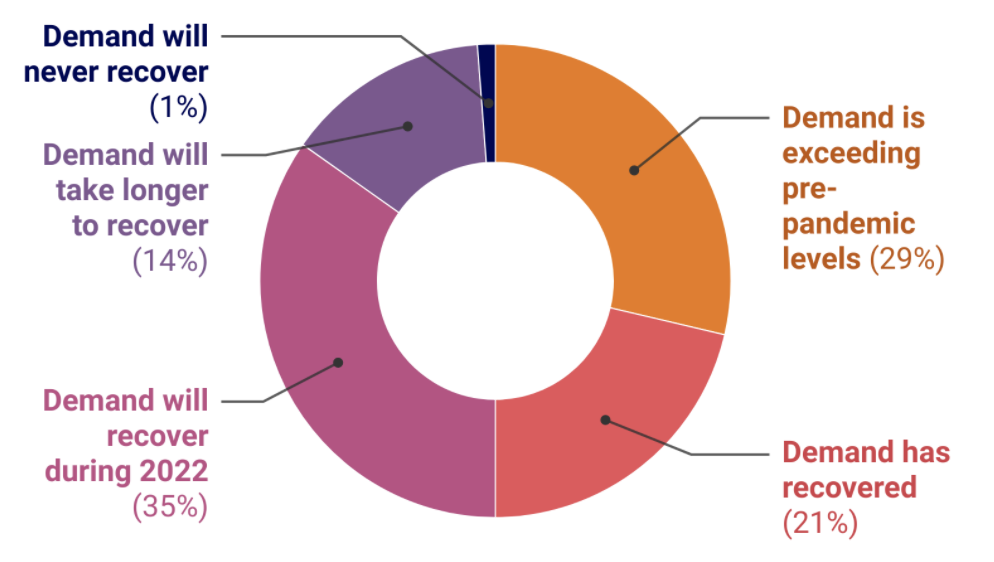

The first, and perhaps most positive highlight from the report is that property managers around the world are confident that the most difficult period of the pandemic is behind us.

In fact, 29% say that demand is already exceeding pre-pandemic levels, while 35% believe that demand will recover in 2022.

The cause for this optimism is most likely the growth that many property managers experienced in the past year despite continued COVID-19 restrictions.

In 2021, booking revenue has remained positive compared to 2019 (8%). Only Asia and Latin America saw a dip in booking revenue compared to pre-pandemic levels.

Property managers expect an overwhelmingly positive revenue growth in 2022 (35% more bookings than in 2019).

In addition, respondents reported an average inventory growth of 111% over the last 12 months, with North America and urban property managers seeing the biggest inventory increase.

Expectations for 2022 are even higher, with respondents looking forward to a 114% inventory growth on average.

Property managers expect the share of direct bookings to increase

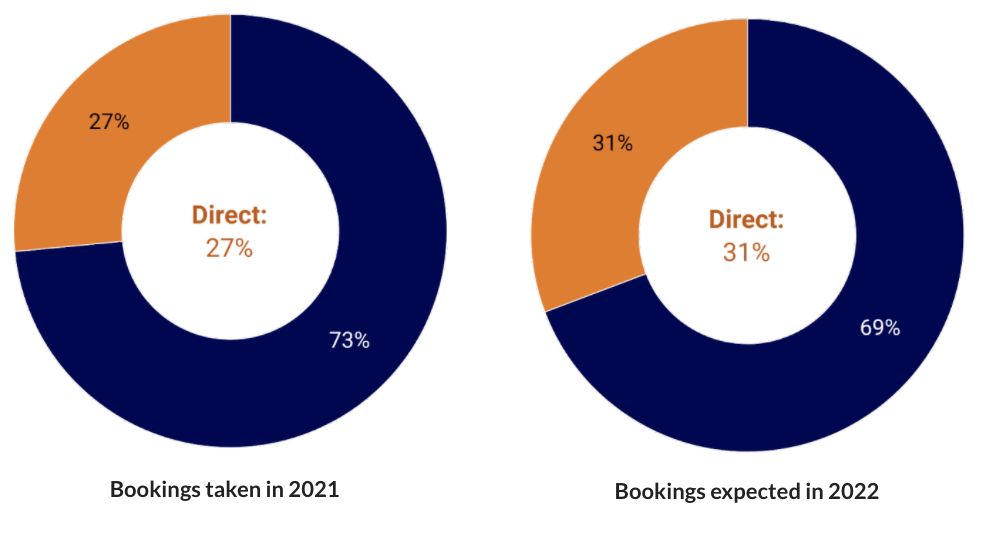

With the majority (73%) of bookings coming from OTAs in 2021, channels like Airbnb, Vrbo and Booking.com remain a vital source of bookings and a necessity for most property managers.

However, the share of direct bookings is increasing, with an overall 27% of bookings coming from direct sources.

Direct bookings tend to increase as a property manager grows; the smallest companies sourced 23% of bookings directly in 2021, while the largest attracted 37% of their reservations through direct channels.

This trend is likely to continue into the future. In 2022, property managers expect 31% of their bookings to be direct (vs 69% coming from OTAs).

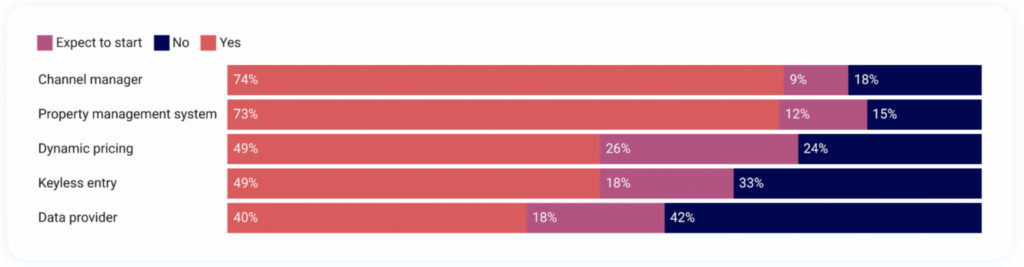

Channel managers are the most-used technology among property managers

Channel managers are the most-used technology (74%), with property management systems following close behind (73%).

Another 9% of property managers expect to start using a channels manager in the future, while 12% expect to start using a PMS.

In addition, 51% of respondents plan to increase their usage of or spending on channel management, and only 8% plan to decrease.

Only 18% of respondents are not using or considering using a channel manager—which is a decrease from surveys of previous years.

Check specific USA Summer 2022 Stats.

On average, 50% of global PM bookings go through a channel manager.

Other popular technologies include dynamic pricing and keyless entry, with 49% of property managers taking advantage of both. (But while 26% more plan to start using dynamic pricing, only 18% plan to start using keyless entry).

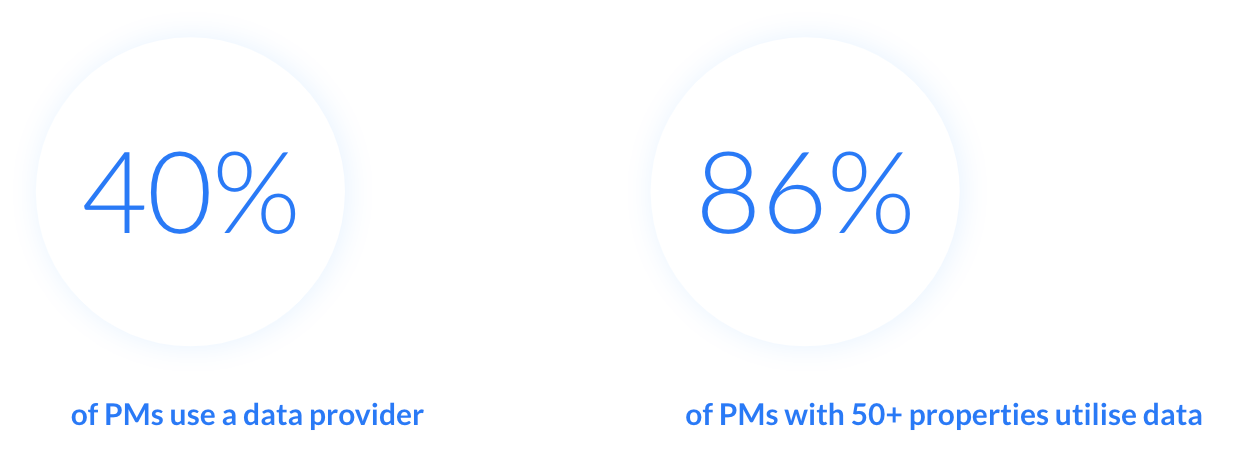

Data usage has increased dramatically since before the pandemic

In addition to evolving technology adoption, data usage has spiked significantly since 2019.

In 2021, 40% of property managers surveyed were using a data provider and 42% weren’t. Plus, a further 18% of property managers are planning to start using external data.

This is huge growth compared to only 13% of respondents using a data provider in the 2019 survey.

Among PMs with 50+ properties, a whopping 86% utilise data, and 11% of PMs spend more than $10,000 on data and market intelligence.

There appears to be a striking correlation between revenue growth experienced last year and data investment. In fact, revenue growth was 21% higher for PMs spending on data.

Those spending $10,000 or more on data annually saw their booking revenue increase by 66% in 2021.

Almost 60% of responding PMs plan to increase their utilisation or spending for 2022, and only 6% plan to decrease it.

Service provision varies by property manager region

When it comes to the provision of services, our report found that guest interaction, distribution and key handling are most likely to be handled in-house: 85%, 73% and 68% of property managers reported direct provision of these services respectively. Take a look at the complete charts in our full report.

There were interesting differences in how property managers in different regions handle services. We discovered that property managers in Asia provide the most services directly, while North American PMs are most likely to utilise partners.

Download the full report to learn more

For more in-depth insights, download the Global Vacation Rental Report 2022.

You will find a breakdown of our findings by region (Europe, North America, Latin America, Asia and Oceania) and destination type (urban, coastal, rural and ski markets).

In addition, you will have access to many more data points regarding distribution and marketing, technology adoption, pricing strategies and service provision, as well as property managers’ opinions on COVID-19 recovery, operations and regulation.

See market data on Top Performing Cities.

Consult the 2022 Trends Forecast.