Looking for the latest vacation rental statistics and trends for 2022? You’re in the right place!

Here at Rentals United we pride ourselves on helping vacation rental property managers stay alert to new markets and trends, and continually improve our channel manager to help you achieve revenue success.

Staying on top of the latest stats is key—because “hoping and praying” is not a sustainable strategy! With the latest data, you can move forward in your business with confidence, and make informed decisions about your next steps.

Keep reading for the latest vacation rental statistics on:

- Growth and revenue

- Travel trends

- Technology and data usage

- Distribution and marketing

- Operations and services

- Large property manager companies

- Property manager opinions and outlook for the year ahead

Data is knowledge, and knowledge is power. So here’s how to superpower your vacation rental business for summer 2022 and beyond.

Rentals United is not just a channel manager, but a partner to help you achieve your business goals. See how we can help you improve your business with a combination of market data, booking performance metrics and a diverse mix of sales channels.

Book a demo now

.

Vacation rental industry statistics: Growth and revenue

Good news for vacation rental property managers: the industry is expected to grow fast globally over the next 12 months. In many markets around the world, vacation rentals closed a record year at the end of 2021 and have an even better forecast for 2022.

Growth

- 80% of travellers say they are actively moving forward with 2022 travel plans ( Evolve)

- 86% of travellers say they plan to book a vacation rental in 2022 ( Evolve)

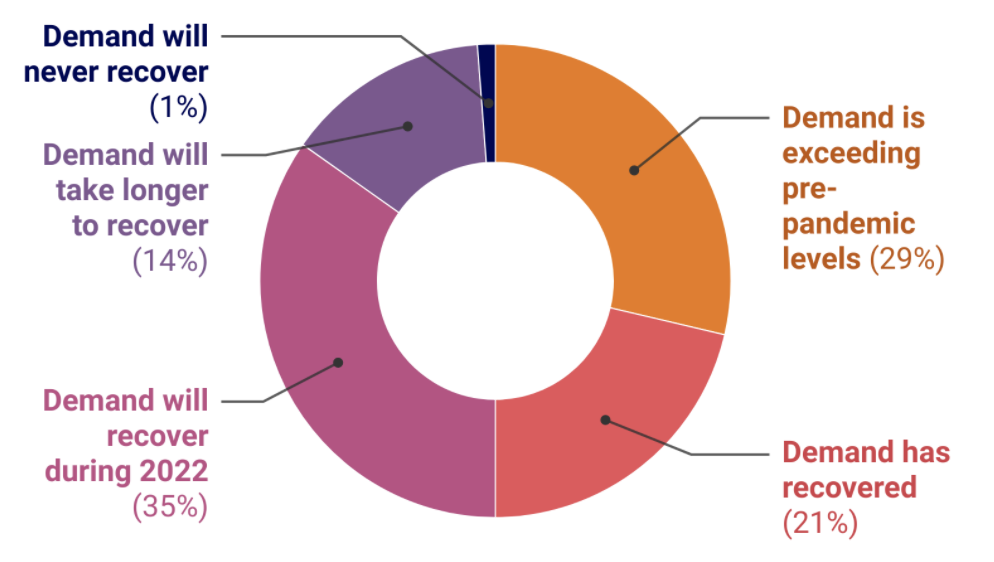

- 50% of property managers believe that recovery from Covid-19 is either complete or demand is exceeding pre-pandemic levels (29% exceeding, 21% demand has recovered) ( Rentals United & Transparent)

- Expected growth for property managers over the next 12 months is at 114%, up from 112% last year ( Rentals United & Transparent)

- Latin America is the region expecting to see the biggest inventory growth in the next 12 months, at 259%, followed by North America (148%), Europe (79%), Oceania (66%) and Asia (47%) ( Rentals United & Transparent)

- However, North America is the only region to see lower expected growth this year (148%) compared to last year (231%). ( Rentals United & Transparent)

- Property managers are expecting to see the highest growth in urban areas (111% over the next 12 months), versus 90% in rural areas, 86% in coastal areas, and 55% in ski resorts. ( Rentals United & Transparent)

- US listings in 2022 are expected to increase 15% in 2022 compared to 2021, especially across large cities and resort markets ( AirDNA)

- Demand in urban areas is expected to grow by 33%, mainly as these areas catch up from being hit hardest during the pandemic ( AirDNA)

- Demand is expected to grow for vacation rentals globally in 2022 by 14.1% compared to 2022 ( AirDNA)

- However, some areas will not see demand recover to 2019 levels until 2023, including cities such as New York, Boston, and San Francisco ( AirDNA)

Revenue

Revenue in North America is expected to grow by 42% over the next 12 months, the same as Latin America, and just ahead of Oceania (33%), Europe (32%) and Asia (24%). ( Rentals United & Transparent)

Rentals United & Transparent

- Property managers worldwide are expecting booking revenue to grow by 35% in the next 12 months, up significantly from 8% in the previous 12 months ( Rentals United & Transparent)

- Revenue growth is predicted to be highest in Latin America and North America (both 42%), followed by Oceania (33%) and Europe (32%) and Asia (24%) ( Rentals United & Transparent)

- Worldwide revenue in the vacation rentals sector is predicted to reach US$81.143billion in 2022, with most of it generated in the US ($17.660billion in 2022) ( Statista).

- Worldwide, the number of vacation rental users is expected to hit 893.7m by 2026, with user market penetration at 9.2% in 2022, and 11.3% by 2025 (meaning more than one in 10 people have been vacation rental guests). ( Statista)

- Globally, the average revenue per user is expected to hit US$116.37 ( Statista)

- Worldwide, 73% of total revenue will be generated via online sales by 2026 ( Statista)

- In the US, revenue per available room (RevPAR) is expected to hit $149.41 in 2022. This is down 4.8% compared to the $156.62 figure from 2021. ( AirDNA)

Vacation rental statistics: Travel trends

The statistics for summer 2022 indicate a notable trend towards advanced planning. Amidst the ongoing influence of remote work, there’s a noticeable shift towards extended stays in vacation rentals, reflecting a preference for longer family vacations and increased convenience. Despite this forward-looking approach, there remains a lingering expectation among guests for flexible booking and cancellation policies, possibly stemming from the lingering effects of the Covid era.

Remote working and seasonality change

- Peak seasons are set to continue lengthening as more workers have flexibility, although it is “hard to say whether that demand is sustainable” beyond 2022 ( AirDNA)

- Flexible working is the “next big flex”, with summer 2022 expected to revolve around flexible travel, as 60% of employers with offices expect to remain with, or move to, a hybrid model ( AirDNA)

- Travellers over age 40 are more likely to plan extended stays and work/remote trips, compared to those under 40, of whom 54% plan trips of 3-4 nights only ( Evolve)

- On Airbnb, family long-term stay nights grew 75% from summer 2019 to summer 2021, with this trend expected to continue in 2022 ( Airbnb)

- 44% of families said they are more likely to work remotely from a place that’s not their own home ( Vrbo)

- Families are booking longer trips; 21-30-day stays have increased 68% on Vrbo ( Vrbo)

- 43% of parents say they are now more likely to let their kids skip school for a vacation ( Vrbo)

- Undated searches rose by 33% year over year, indicating that families do not necessarily have to vacation during school breaks or company holidays ( Vrbo)

- 20% of nights booked on Airbnb in Q3 last year were for stays of 28 days or longer ( Airbnb)

Advance planning

- Guests are expected to “plan further in advance for 2022 to secure top properties in the most desirable locations” ( AirDNA)

- 59% of travellers plan on booking trips two to five months in advance ( Evolve)

- 60% of travellers say they plan to book their vacation earlier than they did in pre-pandemic times ( Vrbo)

- Average booking activity on Vrbo occurred on average two to three months earlier than in pre-pandemic times ( Vrbo)

- 50% of travellers say flexible cancellations and rebooking policies are a top factor in their 2022 travel decisions, as well as upgraded decor and furniture, far ahead of cleanliness (23%) ( Evolve)

Wellness, self-care, and the great outdoors

- Wellness and relaxation experiences are expected to see increased demand (61% of travellers say they are interested in booking these in 2022), followed by outdoor experiences such as hiking, biking or kayaking (58%) ( Evolve)

- Ski chalets in the US on Vrbo have seen an 85% increase in demand year-on-year ( Vrbo)

- 77% say that the simple pleasure of feeling the sun on their skin will improve their mood ( Booking.com)

- 79% of travellers agree that travel helps their mental and emotional wellbeing more than other forms of self-care, with “travel set to become the self-care trend for 2022” ( Booking.com)

- Just 6% and 7% of travellers respectively say they are planning a shopping and concert/festival experience as their top choice in 2022 ( Evolve)

Travelling with pets

- Demand for pet-friendly vacation homes on Vrbo grew 40% year-on-year ( Vrbo)

- 70% of travellers said they were also pet owners, with 68% of them having travelled, or wanting to travel, with their pets ( Vrbo)

- The top reason for travelling with pets is because families don’t like leaving them, followed by wanting the whole family to be together ( Vrbo)

New connections and exploring

- 60% of travellers are looking forward to meeting new people while on vacation in 2022 ( Booking.com)

- 50% of travellers are hoping for a vacation romance while on vacation in 2022

- 58% say they enjoy learning new and unfamiliar transportation systems when travelling ( Booking.com)

- 58% of travellers agree it’s important that their trip is beneficial to the local community at their destination ( Booking.com)

- 29% are going to do more research into how their tourism spend will affect or improve local communities ( Booking.com)

Vacation rental statistics: Technology usage

More than ever, technology is a major factor in travel in 2022—whether it’s property managers using it to facilitate online check-in and security, travellers using it to improve their safety, or guests looking to unplug and boost their work-life balance.

Tech-based travel

- 64% of travellers agree that technology will be more important than ever while on vacation ( Booking.com)

- 49% of property manager companies currently use keyless entry tools, and 18% expect to start in 2022 ( Rentals United & Transparent)

Rentals United & Transparent

Unplugging for work-life balance

- Despite the rise of remote working, not everyone is planning on working when they travel. 73% of travellers say that some vacation time will be strictly work-free in the future, as more people establish a healthy work-life balance away from work devices ( Booking.com)

- 77% of families agreed that they have a greater appreciation for separating their professional and personal lives, compared to pre-pandemic times ( Vrbo).

- 61% of parent travellers said they are more likely to require their children to disconnect from their devices on vacation ( Vrbo)

- 42% of travellers say they are less likely to check work email on vacation post-pandemic ( Vrbo)

Tech for Covid and travel anxiety

- 63% of travellers believe that technology is important in controlling health risks when travelling ( Booking.com)

- 62% of travellers agree that technology helps to alleviate their travel anxiety ( Booking.com)

- 69% of travellers would be interested in a service that could predict which countries will be safe to travel to, even months in advance ( Booking.com)

- 67% of travellers would be interested in a service that would automatically suggest destinations which are easy to travel to now based on their country’s and the destination’s current COVID-19 requirements ( Booking.com)

Vacation rental statistics: Distribution and marketing

Major shifts are expected in 2022, with direct bookings set to grow in importance, although the major OTAs—such as Airbnb, Booking.com, Vrbo, Expedia, TripAdvisor and others—are still set to remain dominant and necessary for all but the largest operations.

Direct bookings on the rise

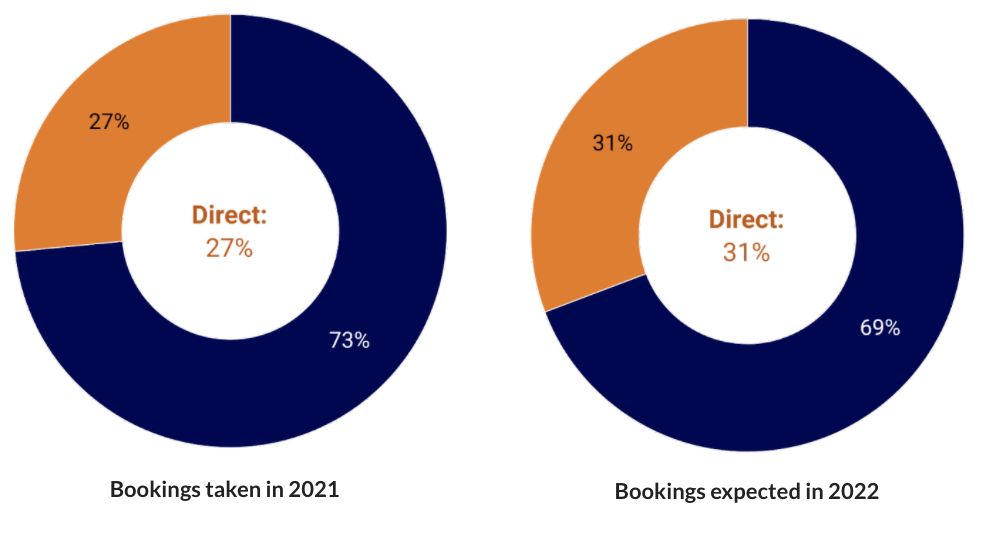

- Direct bookings for vacation rentals are expected to rise to 31% of the total (versus 69% via OTAs) in 2022 ( Rentals United & Transparent)

- This represents a rise of 4% up from 2021 when direct bookings were at 27% (versus 73% from OTAs). ( Rentals United & Transparent)

- 60% of property managers say distribution costs are increasing, but at the same time, 59% say that direct bookings are increasing ( Rentals United & Transparent)

Rentals United & Transparent

Channel managers and other tools

- 74% of property management companies use a channel manager, with 9% expecting to start in 2022 ( Rentals United & Transparent)

- 49% of property management companies use a dynamic pricing tool, with 26% expecting to start in 2022 ( Rentals United & Transparent)

- 40% of property management companies use a data analysis tool, with 18% expecting to start in 2022 ( Rentals United & Transparent)

- 51% of property managers say that they plan to increase spending on channel management in 2022 (while 41% will stay the same, and 8% will decrease) ( Rentals United & Transparent)

- Airbnb.com and Booking.com were the number one most-visited websites within the accommodation and hotels category worldwide, while Expedia.com was at number three, and Hotels.com and Vrbo.com at number four and five respectively ( SimilarWeb) in 2022.

Rentals United & Transparent

Vacation rental statistics: Operations and services

The majority of property managers are offering major services directly or in-house, although a significant proportion are still offering these through partners.

- When it comes to guest interaction, 85% of property management companies provide it directly, while 5% apiece use a partner, or are considering it for 2022 ( Rentals United & Transparent)

- 68% offer key handling directly, while 14% offer it through a partner, and 5% are considering offering it directly for 2022 ( Rentals United & Transparent)

- 41% directly provide maintenance, while 37% do so through a partner, and 9% are considering offering it directly for 2022 ( Rentals United & Transparent)

Vacation rental statistics: Large property management companies

Larger property management companies (those with 50-100+ properties) are using more tools than ever to automate and facilitate their operations, and making the most of them, such as connecting to a PMS, updating rates frequently, and tapping into the power of data.

- The world’s top 50 property managers are in just 15 countries. They are the US, UK, France, Spain, Italy, Denmark, Germany, Poland, Finland, Austria, the Netherlands, Ireland, Croatia, Switzerland, and Poland ( Rentals United)

- In the US, the top property managers are in just 12 states. They are Oregon, Colorado, California, Louisiana, Alabama, South Carolina, North Carolina, Tennessee, Florida, Arizona, New York, and Massachusetts. ( Rentals United)

- 98% of all large property managers (with 100+ properties) already use a PMS, with 2% expecting to start in 2022 ( Rentals United & Transparent)

- 60% of property managers with 100+ properties update their rates daily, compared to just 21% of those with 2-9 properties ( Rentals United & Transparent)

- 86% of property managers with 50+ properties utilise data via a data provider tool today ( Rentals United & Transparent)

- Property managers with 100+ properties currently spend more than $5,000 each year on data providers and management ( Rentals United & Transparent)

- 60% of property managers plan to increase their utilisation or spending on data for 2022 ( Rentals United & Transparent)

Rentals United

. Click map to enlarge.

Property manager opinions and outlook

Overall, property managers appear optimistic, with the majority believing that the market has already recovered from Covid, or if not, will do so this year. A significant minority are even positively confident for the year ahead, saying that bookings are already exceeding pre-pandemic levels.

Covid recovery

- 57% say they are not worried about post-Covid-19 demand recovery, compared to 32% who say they are ( Rentals United & Transparent)

- 35% of property managers believe that demand will recover from Covid-19 in 2022, while more than one-fifth (21%) of property managers believe that demand in 2022 has already recovered from Covid ( Rentals United & Transparent)

- 29% of property managers believe that demand in 2022 is already exceeding pre-pandemic levels ( Rentals United & Transparent)

Rentals United & Transparent

Listings and bookings overall

- While 40% say that finding new listings is getting harder, 45% disagree ( Rentals United & Transparent)

- 62% disagree that bookings are decreasing overall, versus 21% who say they are ( Rentals United & Transparent)

- 55% say that regulations are not negatively impacting their business, but 65% disagree that more regulations should be introduced ( Rentals United & Transparent)

Vacation rental statistics and trends 2022: The bottom line

Overall, the future looks bright for vacation rentals in 2022. The vast majority of travellers are returning to the market with gusto, property managers are optimistic about Covid recovery, and revenue is projected to rise significantly over the next 12 months.

Remote working and longer, more flexible stays are increasing in popularity, as are outdoor trips and wellness experiences, and a set-up that enables a greater work-life balance.

More travellers are looking to explore with their children and pets. Advance booking availability and flexible cancellation policies will also be of greater importance, as will connected technology and direct bookings versus OTAs alone. With worldwide revenue for vacation rentals expected to reach US$81.143billion this year, growth is expected in all sectors, in the US and worldwide.

Frequently asked questions about vacation rental statistics and trends

How many people use vacation rentals?

Worldwide, the number of vacation rental users is expected to hit 893.7 million by 2026 ( Statista), with estimates suggesting there were 450 million worldwide users in November 2021.

How much is the vacation rental industry worth?

Worldwide revenue in the vacation rentals sector is predicted to reach US$81.143billion in 2022, with most of it generated in the US ($17.660billion in 2022) ( Statista).

How many vacation rental homes are in the US?

Estimates suggest that there are at least 1.3 million vacation rentals in the US ( CNN).

Rentals United is not just a channel manager, but a partner to help you achieve your business goals. See how we can help you improve your business with a combination of market data, booking performance metrics and a diverse mix of sales channels.

Book a demo now

.